Many UK SMEs now depend on external finance, and Funding Agent encourages them to view borrowing as a strategic tool rather than a last resort. Through its platform, SMEs can quickly access unsecured business loans of about £1,000–£500,000 from matched lenders, without using property as security and with fast, streamlined applications.

The Role of Unsecured Loans in SME Growth

Unsecured business loans are most valuable when a business needs fast, flexible funding. Because they aren’t secured against specific assets, they can be arranged quickly and used for many purposes, such as hiring, marketing, tech upgrades or working capital, but they work best when tied to a clear goal and a realistic plan to repay from future cash flow.

Used appropriately, unsecured loans can help SMEs:

- Bridge cash flow gaps while waiting for large invoices to be settled.

- Invest in people, technology, or marketing campaigns without putting property at risk.

- Consolidate multiple expensive short-term facilities into a single, more manageable repayment structure.

The common theme, according to Funding Agent, is intent: unsecured funding should support a defined plan to grow or stabilise the business, not mask a fundamentally unprofitable model.

Three Key Questions Before Borrowing

To support more disciplined borrowing decisions, Funding Agent’s guidance sets out three simple questions every SME leadership team should address before taking on new unsecured debt:

- What specific outcome are we funding? New borrowing should be linked to a concrete goal, such as hiring a sales team, upgrading equipment, expanding into a new region, or investing in systems that improve productivity.

- What is the realistic payback path? Management should model conservative cash flow scenarios, including potential delays in revenue and higher interest costs, to ensure repayments can be met without putting day-to-day operations at risk.

- Are we choosing the right lender and structure? Beyond the headline interest rate, SMEs should compare early repayment flexibility, speed and transparency of decision-making, and the lender’s appetite for their specific sector and risk profile.

How Funding Agent Supports Better Decisions

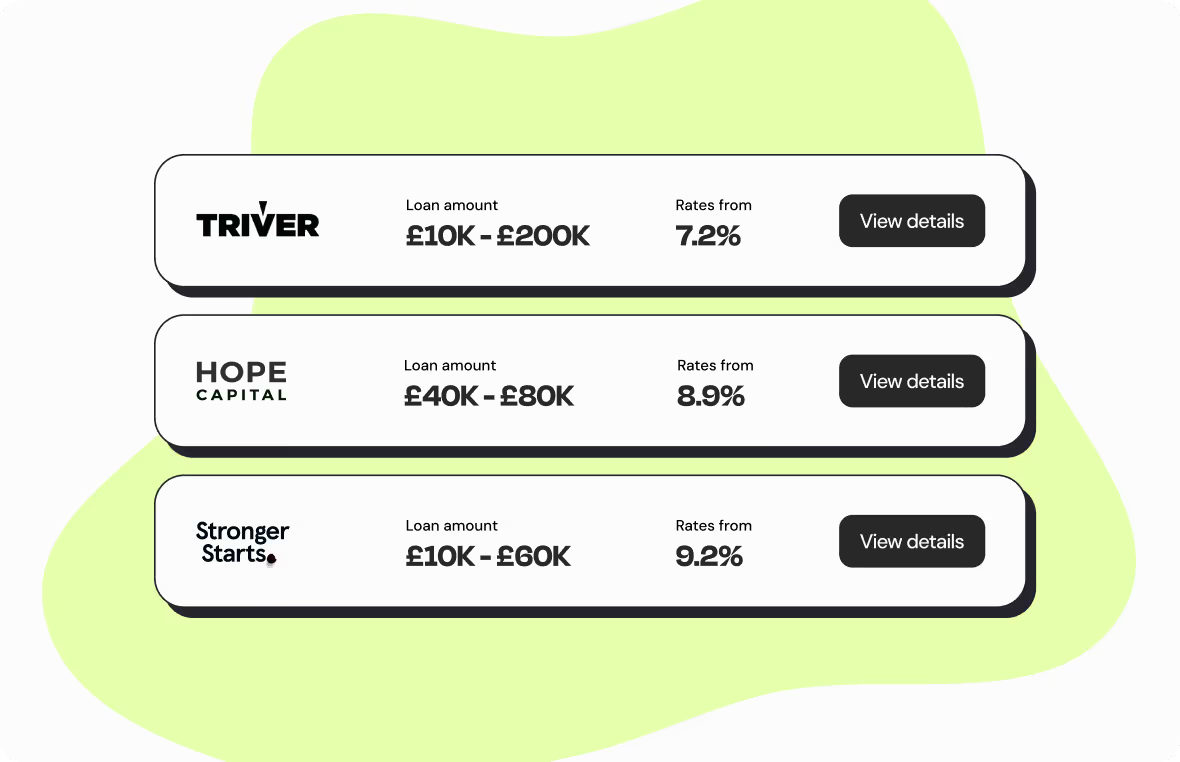

Funding Agent positions its platform as an independent way for business owners to benchmark unsecured loan options before approaching a lender. The platform maps how banks and specialist fintech providers structure unsecured finance, covering eligibility criteria, typical loan sizes, decision times and example use cases. This allows SMEs to view multiple options side by side, including short-term loans, revenue-based finance and merchant cash advances, which are now increasingly used by UK firms that need rapid, unsecured funding.

Time-poor management teams can use Funding Agent’s guides on unsecured business loan providers as a starting point, then narrow down to lenders that match their size, sector and funding requirements. Once matched, they can proceed directly with the provider that best fits their objectives and risk tolerance.

Finance as a 2026 Growth Lever

Against a backdrop of elevated operating costs and continued uncertainty, Funding Agent expects demand for fast, flexible finance to remain strong in 2026. The businesses most likely to thrive, the guidance suggests, are those that build finance into their planning – using products like unsecured loans to support well-defined investments in people, systems and market expansion.

Funding Agent concludes that unsecured loans will not suit every SME, especially those without a clear route to sustainable profitability. However, for founders with robust business plans and disciplined cash flow management, unsecured finance can provide exactly the headroom needed to invest, adapt and stay competitive in the year ahead.