New data reveals a gap between ambition and action, as knowledge shortfalls prevent businesses from accessing capital

UK SMEs overwhelmingly agree that access to funding is vital to growth – but many are holding back, risking knock-on effects for the wider economy. That’s the warning from alternative finance provider Growth Lending, whose latest research shows that despite 84% of SMEs recognising funding as essential, almost a third (31%) didn’t apply for any finance in the past year.

The findings, from Growth Lending’s Geared for Growth 2025 report, highlight a growing disconnect between intent and execution – and come at a critical time for the UK economy. With inflation still stubborn, productivity flatlining, and business investment lagging behind pre-pandemic levels, the ability of SMEs to access capital could define the pace of the UK’s recovery.

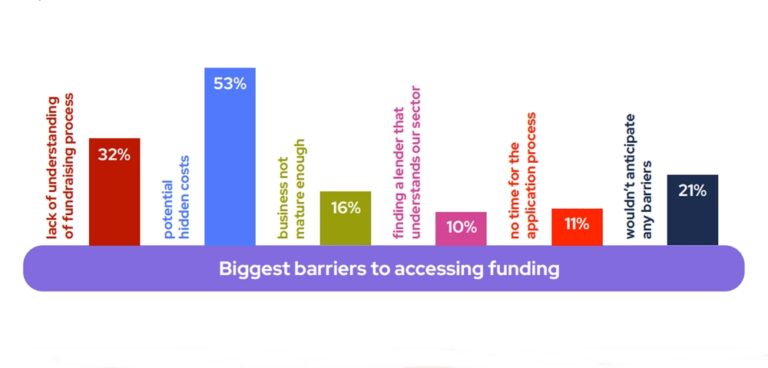

While 67% of SMEs say they plan to secure funding in the next 12 months, confidence in navigating the process remains low. Less than a quarter (23%) rate their own knowledge of the funding landscape as “very good”, and 29% admit to not understanding the process or options at all. Many are also guided by outdated perceptions: 16% believe they’re not profitable or mature enough to qualify for funding – even though alternative routes exist for exactly these kinds of high-potential businesses.

Kimberley Martin, Managing Director at Growth Lending, said: “Business leaders are unanimous about the positive role funding plays in growth, but many are still hesitant to actually pursue a fundraise. Some of this is due to ongoing economic uncertainty, but many are held back from their ambitions due to a lack of understanding of what is available, or outdated assumptions as to what raising finance entails. The risk is that individual businesses are unable to flourish, stalling UK-wide business performance and, more broadly, economic recovery.

“What is needed is not just capital, but clarity. Lenders, advisors and policymakers all have a role to play in closing the knowledge gap that exists. Lenders must take responsibility for educating clients and introducers of their proposition and being more transparent when a business is or isn’t a good fit. This will improve overall understanding of the funding ecosystem, but also give business leaders confidence that when one lender says no, there are plenty of others – likely more suitable! – that will be able to support them.

These SMEs are the businesses that will fuel future economic growth, but only if we, as a collective, help unlock their full potential.”

The report also found that one in five SMEs (18%) have made securing funding their top growth focus for the year ahead – the exact same proportion that cite lack of funding as their biggest growth barrier. With interest rates holding steady but credit conditions still tight, many businesses remain caught between ambition and uncertainty.

As policymakers and economists look to the SME sector to drive investment, employment and innovation, closing the funding knowledge gap could be a critical step in unlocking growth – not just for individual businesses, but for the UK economy as a whole.

Download the full report here: https://growthlending.com/geared-for-growth-report-2025-download-your-copy-now