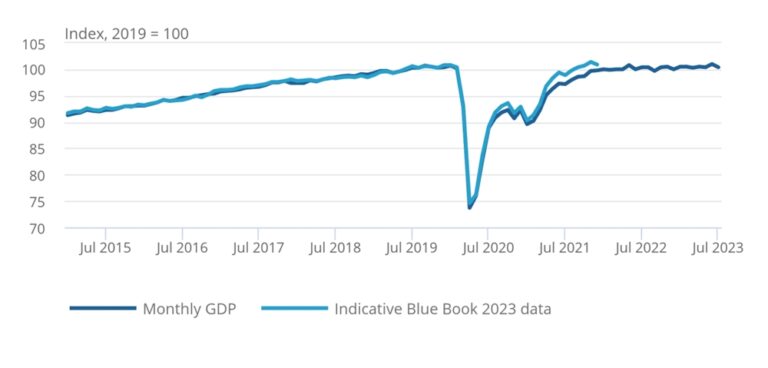

Responding to Office for National Statistics figures showing that GDP fell by 0.5% in July 2023 compared with the previous month, Martin McTague, National Chair of the Federation of Small Businesses (FSB), said:

“This fall in GDP will come as little surprise for small businesses, who have endured uncertain trading conditions over a summer marked by poor weather and still-high levels of inflation.

“It is disheartening to see a fall in the three main sectors of services, construction, and production, with the fall in services especially eye-catching due to the dominance of the service sector in the UK economy.

“The steady increase in interest rates has tightened the screw for many small firms, with many reporting consumer spending contracting as a result, and with firms carrying index-linked debts seeing their repayments rise and rise, hitting their margins.

“This indication that the economy contracted at the start of the third quarter will dampen hopes of a more optimistic finding in small business confidence levels, which stalled in the second quarter following a large improvement at the start of the year.

“Our research also found that confidence levels and revenue growth were drastically different between sectors, with small firms in retail and hospitality notably more pessimistic than professional, scientific and technical businesses, for example. These disparities should be kept in mind so that firms in areas or sectors where growth is less forthcoming are not left out of sight, out of mind.

“Looking forward, falling demand for goods and services and inflation are seen as key challenges for small firms, and we can’t forget that energy bills are still far higher than they were 18 months ago.

“Given the falls in all three main sectors, the Autumn Statement will be a watershed moment for the Government in terms of proving its small business support credentials. A significant step would be to tackle late payments once and for all. Outstanding invoices hold back both growth and stability for businesses, and we will be looking for concrete steps to stamp out this scourge in the forthcoming response to a Government consultation on the topic.

“Another way to encourage growth among small businesses would be to act to lighten the burden of business rates. We would like to see the discount for retail, hospitality and leisure businesses extended for another year, and the Small Business Rate Relief threshold raised from £12,000 to £25,000. Reducing the rates burden would work as a motivating factor to re-energise the entrepreneurial spirit that’s so important in a healthy economy.

“Raising the VAT threshold from £85,000 to £100,000 could also spare both businesses and consumers from the double jeopardy of rising prices and taxes.”