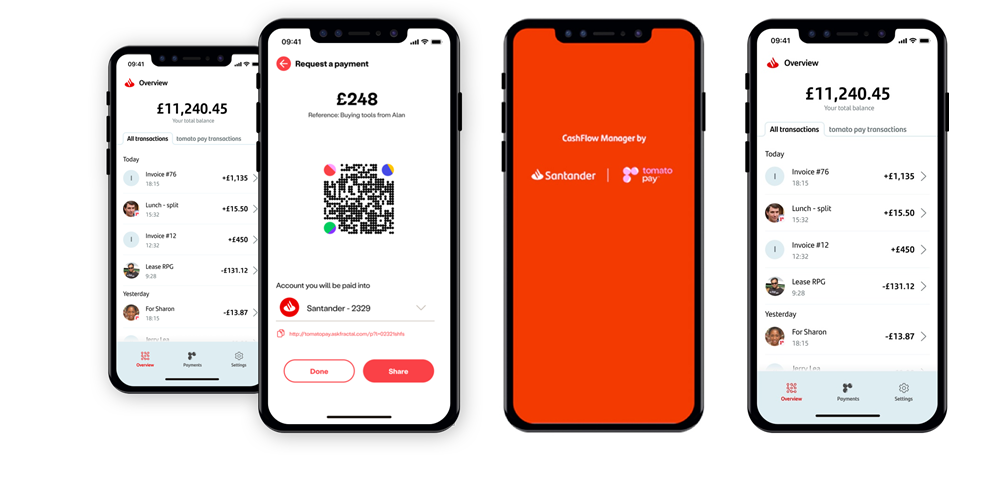

Santander UK has begun the roll-out of an innovative new mobile app, built using open banking technology, for its Corporate and Commercial Banking clients. The app provides Santander UK’s clients with a ‘single view’ of numerous account balances and transactions across their different banks. Created by tomato pay1, an open banking fintech for small and medium-sized enterprises (SMEs), the CashFlow Manager app is also designed to speed up payments through QR codes and simplify invoicing.

CashFlow Manager displays in one neat location all balances and transactions for accounts businesses hold with their various banks. Santander UK’s clients who use the app can link and view their banking details for up to 98% of UK banks.

The app analyses each business’ data to provide it with categorised insights into its spending, for example how its payroll expenditure on a given month compares to its average over a prescribed period. By analysing a business’ transactions, CashFlow Manager also assesses its future cash flow position to provide detailed forecasts.

Speeding up the payments process is at the heart of the app, and among its key features is a QR code-based payments collection facility. CashFlow Manager enables businesses to request payments from their customers by showing a unique QR code either in person or online. When customers use the QR code to pay, the payment is settled immediately in the business’ bank account.

Another of the app’s key features is an invoice processing facility, which is designed to save businesses time by streamlining and semi-automating what is otherwise a manual and time-consuming process. CashFlow Manager embeds the elements of quoting, contract creation and invoicing for businesses to work with their suppliers. It integrates contract acceptance and payment instructions to speed up the process by which companies do business with, and pay, their suppliers.

The app is being tested with selected Santander UK Corporate and Commercial Banking customers with a view to it being launched more widely to customers following the initial roll-out phase. Santander UK is one of the first banks to offer this type of open banking-based app with cash flow forecasting, transaction categorisation and QR code-based payments to UK companies.

John Baldwin, Head, Commercial Clients, Santander UK said: “SMEs are working incredibly hard to get on the road to recovery from the pandemic. The CashFlow Manager app is designed to help them by removing the manual and time-consuming workload involved with day-to-day banking so they can instead focus on running and growing their business. The QR-code payment collection and invoicing features of the app also have brilliant potential to speed up payments to businesses.”

Nicholas Heller, CEO and Co-founder, tomato pay, said: “Together with Santander UK, we’ve created an app that joins two critical elements – cash flow management and payments – to give businesses back their time and money otherwise spent on unnecessary admin and payment processing fees. After a tough year for UK businesses, we wanted to create something with a tangible impact, giving them financial freedom from the minute they log into the CashFlow Manager app.”

More information about the CashFlow Manager app is available on Santander’s website or from Santander’s local relationship team.