New data from Xero, the global small business platform, points to green shoots for UK small businesses, as jobs stabilise and revenue starts to pick up. According to Xero Small Business Insights (XSBI), small business jobs have increased slightly for a fifth consecutive month in the UK, with year-on-year revenues also improving compared to January.

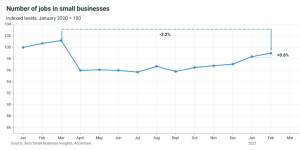

The XSBI programme is produced in partnership with Accenture and is based on analysis of the records of hundreds of thousands of small businesses (anonymised and aggregated for privacy). The February data shows that employment across small businesses is continuing to show signs of recovery with a 0.6% increase in February. Although small business jobs remain 2.2% below pre-pandemic levels.

When analysing the data by sector, job losses in the sectors hardest hit by the pandemic have begun to stabilise, but remain well below pre-crisis levels. The arts & recreation and hospitality industries are down by a fifth (-20.7% and -19.1% respectively) compared to March 2020. Industries less impacted by restrictions have continued to see improvements: jobs in information media & telecommunications grew 10.2% on pre-crisis levels, while professional services went up 5.5%.

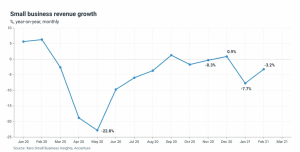

Small business revenues are showing gradual signs of improvement. The protracted down-turn in revenue continued in February, down 3.2% compared to February 2020, but this is an improvement after falling 7.7% year-on-year in January. Hospitality and arts & recreation remain the most severely impacted, down 43% y/y and 33% y/y respectively.

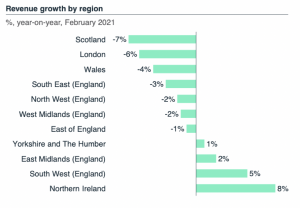

Scotland (-7% y/y), London (-6% y/y) and Wales (-4% y/y) had the largest declines in revenue across the UK, while Northern Ireland (8% y/y), the South West (5% y/y) and East Midlands (2% y/y) saw revenues increase in February.

When looking at average payment times to SMEs, invoices took 1.3 days longer to be paid in February than in January, bringing the average payment time to 31.3 days. Despite the monthly increase this is still six days less than at peak levels of April 2020.

Gary Turner, Xero co-founder, commented: “There are positive indicators and if sustained over the next period, point to the prospect of the economic recovery having begun, albeit slowly.

“We’re continuing to call on and work with the government to ensure small businesses have access to the right support to bounce back strongly.”

These insights have led Xero to identify the key areas needing more support to help small firms to rebuild. The new Road to Small Business Recovery includes recommendations on technology access and the creation of a growth economy. You can read this manifesto here.

More information on the February metrics is available from XERO here latest update.